£410M British Leyland Group To Storm The World Market

By MAURICE CORINA and PHILIP JACOBSON

After months of tough behind-the-scenes negotiations-brought to a head in the past four days by Leyland Motor’s determination to bid, if necessary, for British Motor Holdings-the biggest merger in Britain’s industrial history has been concluded successfully.

The formation of the British Leyland Motor Corporation, hurriedly announced yesterday as a wave of speculative share buying began hitting the Stock Exchange, creates the second largest motor manufacturing group outside the United States and Britain’s fifth biggest company by sales value.

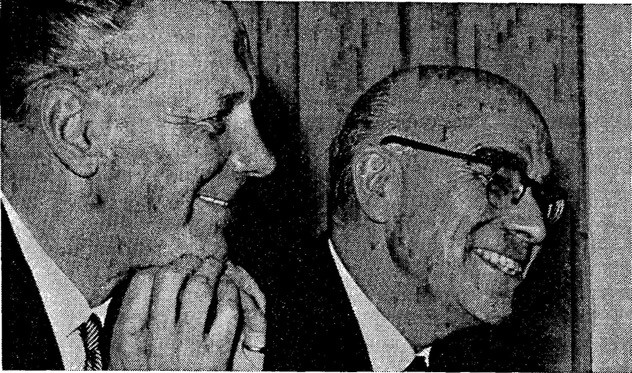

Last night, both Sir George Harriman, chairman elect of the new corporation, and Sir Donald Stokes, nominated as deputy chairman, managing director and chief executive, declared that a combination of Leyland’s marketing and research skills and B.M.H.’s huge production facilities would enable the wholly British-owned enterprise to storm world markets against the fierce competition of American, Continental and Japanese producers. Headquarters of the new group will be in London, where Sir Donald masterminds the Leyland empire.

Under the merger terms, the new corporation will acquire all the issued ordinary shares of B.M.H. and Leyland – the joint market capitalisation at current prices is £410m. – on the basis of one new share for each ordinary share of the two companies. Current market valuation of Leyland’s is around £217m., and £193m. for B.M.H.

The Industrial Reorganisation Corporation, which has played a crucial role as arbitrator in the negotiations, is making £25m. available as loan capital for future expansion.

Immediate intention is that Sir Donald and Sir George will get down to planning the economies and rationalisation made possible by the deal.

By and large, the aim is to establish a streamlined tightly managed enterprise operating with a management policy akin to that of the American giants, such as General Motors and Ford. Distributors of cars and commercial vehicles in home and overseas markets will find their trading records harshly scrutinised. Last night, Sir Donald said those with good records had nothing to fear.

The combined enterprise, with around 200.000 employees and £800m.-a-year sales, becomes Britain’s biggest single exporter.

Sir Donald plans to be off next month to study some of the most important operations overseas.

For the first time, a British motor manufacturer will have a complete range of vehicles, from tractors and earthmoving equipment to cars, vans, and heavy commercial vehicles, including a monopoly of bus making. The products of the two companies are generally complementary, filling gaps in each other’s range. Last year the combined production was 913,000 vehicles, but the best previous production figure worked out at close on 1,100,000.

The pitching of the merger terms surprised the City. On the basis of the group’s respective market ratings and share prices before the bid rumours intensified earlier this week, some weighting in Leyland shareholders’ favour could have been expected. But Sir Donald firmly rejected the suggestion that he has been overgenerous.

We would almost certainly have had to pay more with a takeover bid “, he emphasised. And forcing a bid through would have been “disastrous” for morale and relations in the new group. Leyland’s decision last October to alter their share capital was the first move to bring the two groups’ capital structure more into line.

But Leyland was clearly prepared to buy B.M.H. in the last resort. At a late stage in the final negotiations when deadlock was threatened, this alternative was openly stated before agreement was reached.

Dealings in B.M.H. shares yesterday were the heaviest for years and the share price was already rising before the merger was announced. This prompted both groups’ advisers – Warburgs for Leyland and Cooper Brothers and Schroder Wagg for B.M.H. – to issue the statement earlier than anticipated and well before the Stock Exchange closed.

B.M.H. shares immediately shot up 2s. to 16s. before slipping back to close at 15s. Leyland quickly dropped 2s. to 15s. but were 15s. 6d. when dealings finished.

New World Order:

New World Order:

[table id=900 /]